Commercial Loan Calculator – How to Calculate Business Loan Smartly

If you are starting your business or you want to grow your business, then you need money, which is why tools like the loan calculator and the commercial loan calculator are very useful for you. With the help of these tools, you can easily understand how much loan you should take and what the schedule will be.

- How to use a commercial loan calculator

- How to calculate EMI and total loan cost from the commercial loan calculator

- How to understand the repayment schedule for long-term interest

- What are commercial loans, and different types of commercial loans

- How to choose a business financing option

If you are planning to take a loan for business, then this guide will help you step by step

If you want to Use the Tool Here is the Link: Commercial Loan Calculator

What is the Commercial Loan Calculator, and why is it important?

Loan calculator commercial is an online tool that helps to calculate a business loan. By using it, you can see the EMI and total representation schedule based on the interest loan amount, loan term, and repayment frequency.

This tool is specially designed for business owners who want to accurately estimate their financial plans. If you depend on guesswork, you may have to take more or less loan, which can create problems for you in the future.

Commercial Loan Calculator – Your Business’ Financial Companion

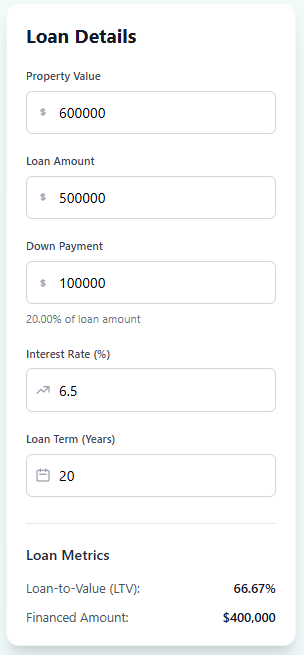

A commercial loan calculator is a beneficial tool for you; it will help you a lot in understanding every detail related to your loan. You don’t have to do anything from school; you just have to complete the inputs like

- Loan Amount – How much loan do you need

- Interest Rate – How much percentage of interest will be charged

- Loan Term – How many salons do I have to repay

- EMI Type – Monthly, quarterly, and yearly payment structure

You have to enter all this information into it, and the calculator will give the result immediately

What will be the EMI, how much total interest will have to be paid, and what will be the total repayment after loan completion? This will help you make smart financial decisions.

Step-by-Step: How to Use a Commercial Loan Calculator

Step 1 – Disburse the loan amount

Understand the requirement and enter the loan amount of your business. Whether it is for buying equipment or for any expansion, the amount should be realistic.

Step 2 – Fill in the interest rate

Check the current rate of the bank or lender. The higher the loan interest, the higher will be the EMI and total cost.

Step 3 – Choose the loan term

Set the number of salons for which you want to repay the loan. In the long term, the EMI is less, but the total interest becomes higher.

Step 4 – Select Repayment Frequency

Choose the monthly repayment or quarterly option that is suitable for your cash flow.

Step 5 – Review the EMI and total cost

The calculator will automatically calculate the EMI and get the total interest. This makes it easy for you to understand the impact of the loan.

Step 6 – Adjust the inputs

You can analyze different scenarios by changing the loan amount or term. So it will be easy.

Types of Commercial Loans

Term Loan

Loan for a fixed period, for expansion or purchase.

Line of Credit

Option to draw funds as per requirement. Interest is charged only on the amount used.

SBA Loan (Small Business Administration Loan)

Government-backed loan, with low interest and long repayment term.

Equipment Loan

For purchasing business equipment and machinery.

Real Estate Loan

For purchasing or renovation of commercial property.

Bridge Loan

Short-term loan until long-term finance is arranged.

Calculator helps to calculate the repayment and cost of all these loans.

Benefits of Commercial Loan Calculator

✔ Saves time and effort

✔ Helps in financial planning and managing cash flow

✔ Helps in comparing loans

✔ Saves unexpected EMIs

✔ Gives accurate and updated calculations

✔ Helps in planning budget and growth strategy

Common Mistakes That Should Be Avoided

Ignoring processing fees

Considering the interest rate as fixed

Not considering tax and legal charges

Taking too much loan can cause problems in the future

Not looking at the amortization schedule

Always review the loan terms after calculation and take advice from a financial expert.

FAQs – Frequently Asked Questions

Q1. Does the commercial loan calculator work for all business loans?

Yes, you can use it for term loan, line of credit, SBA loan, equipment loan etc.

Q2. Are the calculations in the calculator the same for every lender?

No, it only gives an estimate. Actual terms will depend on your credit score and lender policies.

Q3. Can an extra payment also be calculated?

Advanced calculators have an option for an extra payment, which helps in closing the loan quickly.

Q4. Is financial knowledge required to use the calculator?

Absolutely not! These tools are user-friendly and give results on filling in basic details.

Conclusion

If you are planning a loan for any of your businesses, then the commercial loan calculator is an important tool. It not only helps you in calculating your EMI and interest, but also supports you in better financial planning.

Even if you are a start-up or an established business owner, you can manage people effectively by using the calculator. With the help of the commercial loan calculator, you can make your business financially secure.